rhode island tax rates 2020

Find your gross income. The current tax rates and exemptions for real estate motor vehicle and tangible property.

Rhode Island Income Tax Calculator Smartasset

The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. 1 Rates support fiscal year 2020 for East Providence. East Providence City Hall 145 Taunton Ave.

Finally we add 8809 to the base taxes 70800 to get a total Rhode Island estate tax burden of 79609 on a 32 million estate. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. 2021 Tax Rates.

That sum 122344 multiplied by the marginal rate of 72 is 8809. Includes All Towns including Providence Warwick and Westerly. Rhode Island Residential Tax Rates 15 15 to 20 20 Click tap or touch any marker on the map below for more detail about that towns tax rates.

1 to 5 unit family dwelling. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. The tax rates for the 2021-2022 fiscal year are as follows.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. 75 of NADA Value and a 5000 ExemptionAll rates are per 1000 of assessment. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

FY2022 starts July 1 2021 and ends June 30 2022Residential Real Estate - 1873Commercial Industrial Real Estate - 2810Personal Property - Tangible - 3746Motor Vehicles - 3000Motor vehicle phase out exemption. At the close of each experience year September 30 the ending balance in. Find your income exemptions.

3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. The Rhode Island Department of Revenue is responsible for. 3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income.

2020 tax bills are for active businesses during the 2019 calendar year. The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. Easy Fast Secure.

Thu 06102021 - 139pm. 2022 Rhode Island state sales tax. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax.

1800 for every 1000. Federal excise tax rates on various motor fuel products are as follows. 2020 Rhode Island Property Tax Rates Hover or touch the map below for.

2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily. Of the on amount Over But Not Over Pay Excess over 0 66200. The price of all motor fuel sold in Rhode Island also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration.

Levels of taxable income. Exact tax amount may vary for different items. This page has the latest Rhode.

Find your pretax deductions including 401K flexible account contributions. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. 3 rows Rhode Islands 2022 income tax ranges from 375 to 599.

East Providence RI 02914. 3 rows 2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and. Rhode Island Estate Tax.

7 Rates rounded to two decimals 8 Denotes homestead exemption available 6 Motor vehicles in Portsmouth Richmond Scituate are assessed at. 2 Municipality had a revaluation or statistical update effective 123119. DO NOT use to figure your Rhode Island tax.

You have an active business if you have not properly closed your business by either closing with the Assessors office in person or by filling out the Close of Business form by mail. The Rhode Island State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The employer tax rates in these schedules include a 021 Job Development Assessment which is credited to the Job Development Fund and a 003 Reemployment Assessment for calendar years 2001 2002and 2003 that is credited to the Employment Security Reemployment Fund.

The estate tax in Rhode Island applies to gross estates of 1648611 or more for deaths occurring after Jan. Rhode Island Gas Tax. Any income over 150550 would be taxes at the highest rate of 599.

Estates above those exemptions are taxed at rates ranging from 08 to 16. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. Businesses registered in Newport RI are taxed for the PREVIOUS calendar year ie.

2020 Tax Rates.

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

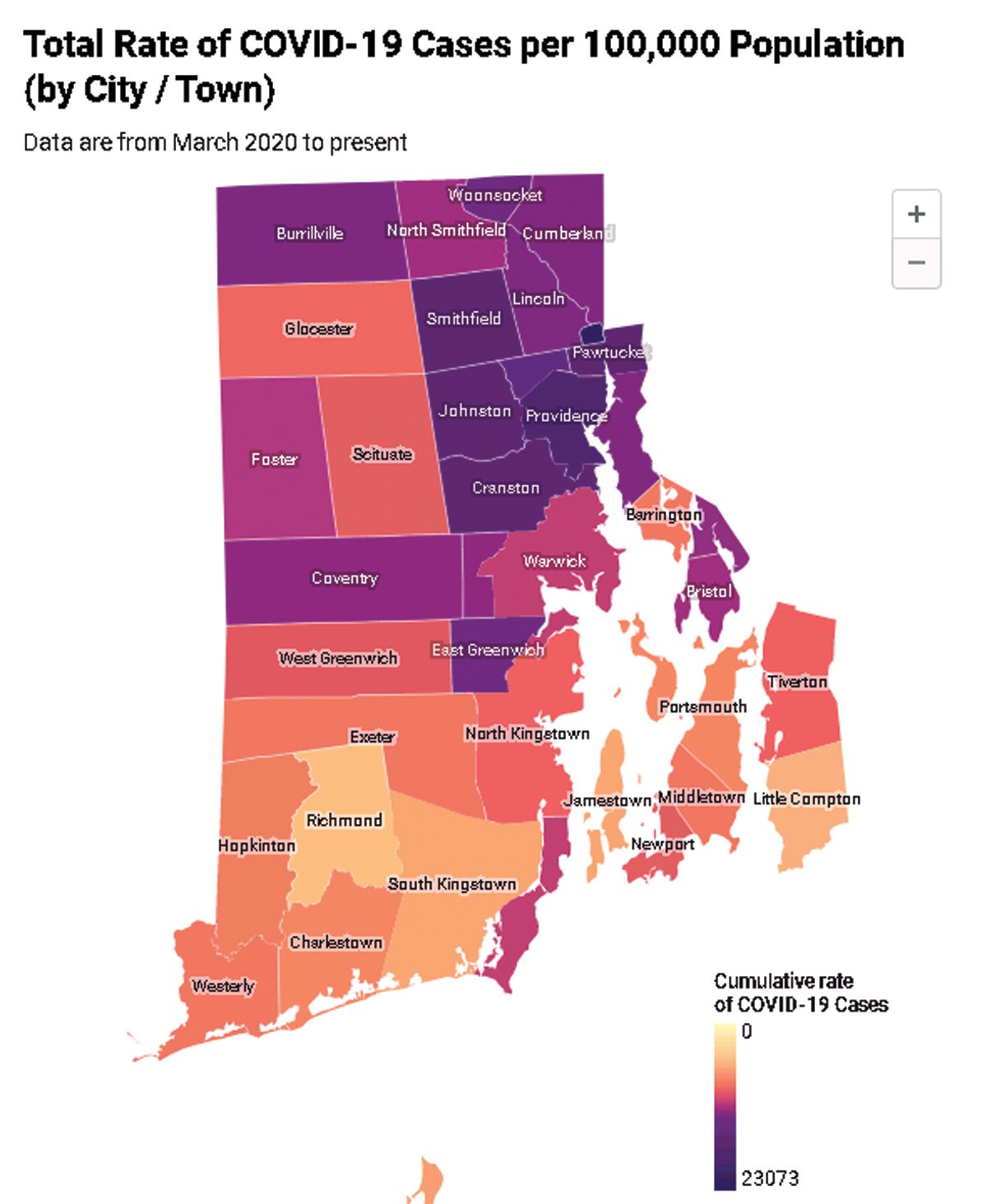

Johnston Among Rhode Island Communities Hardest Hit By Covid 19 Johnston Sun Rise

Renewable Energy Solar Rhode Island Office Of Energy Resources

Rhode Island Income Tax Brackets 2020

Climate Change In Rhode Island Wikipedia

Rhode Island Estate Tax Everything You Need To Know Smartasset

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Rhode Island Foreclosures And Tax Lien Sales Search Directory

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Discover 20 Of The Most Interesting Facts Of Rhode Island Economic Ones Too

William Coddington Colonial Governor Of Rhode Island Britannica

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

Estate Tax Ri Division Of Taxation

Rhode Island College Official Bookstore

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog