non filing of tax return meaning

The 2020 transcript will not be available until sometime after the IRS processes the return which might not be until a few months from now. Verification of Non-filing Letter - states that the IRS has no record of a processed Form 1040-series tax return as of the date of the request.

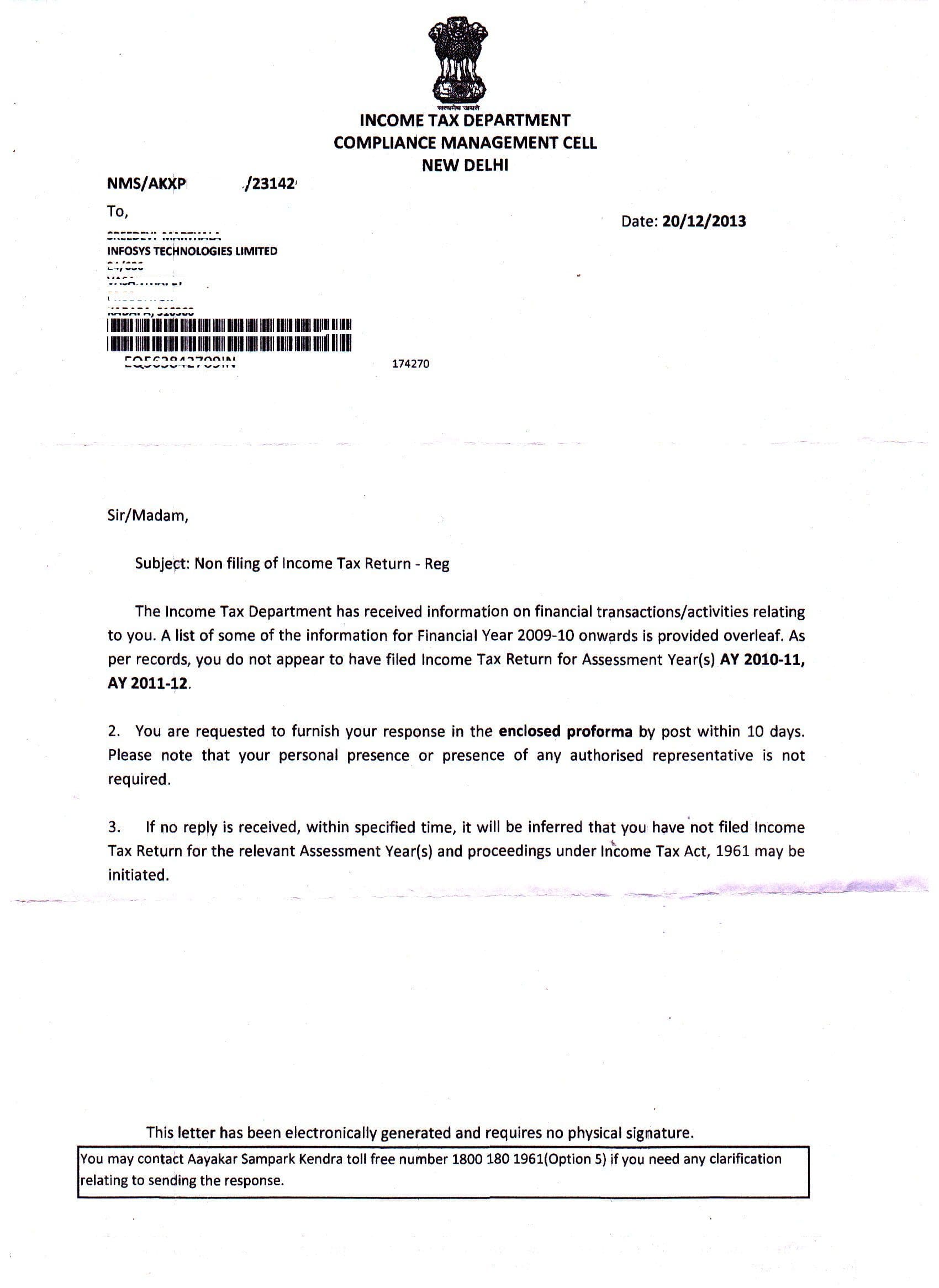

How To Respond To Non Filing Of Income Tax Return Notice

If you fail to file your tax returns for several years in a row it may be interesting to know that the IRS could have been filing returns for you.

. Here is how you can handle a notice for Non-Filing of Income Tax Return. People generally do not take the filing of the income Tax returns seriously. The IRS is showing the Verification of Non-filing letter because they have not yet processed your 2020 tax return.

I have a tax return that I can still download. Kindly note that if there is no taxable income then there is no need to pay tax or file income tax return. That means you do have a tax debt that continues to accrue interest over the years and because you havent been doing your taxes the IRS simply takes the income it assumes youve earned and doesnt apply any eligible deductions.

2020 for verification of non-filing of returns for the above tax period or periods. I mean I got a receipt from TurboTax. For the financial year 2013-14 he skipped filing the IT Return as he changed his job and also his gross income did not exceed the standard deduction limit.

Non-filing of Income Tax Return by itself would not mean that the complainant had no source of income and thus no adverse inference can be drawn in this regard only because of absence of Income. Generally you will be required to submit your Income Tax Return if in the preceding calendar year. A person with taxable income fails to file his ITR or is found to under-report his income in the returns.

You or your parents may be required to provide verification that you did not file a federal tax return as part of the federal verification process. 50 of the total tax payable on the income for which no return was furnished. If requested on your FAST page please obtain a Verification of Non-Filing letter from the IRS and submit a copy to the Financial Aid Office.

Income on which the tax liability was not satisfied by the withholding of tax at the source. You may be an NRI with no taxable income in India invested huge money in a property located in India and you may end up in getting a notice for non-filing of return. I would think that the lender is aware that IRS processing is severely backlogged this.

Whether the non-compliance is a mere omission or a deliberate attempt to. You have self-employed income with a net profit more than 6000. The Non-filling of the Income Tax returns leads to attracting the interest penalty and their persecutions from the Department.

The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public. You are a non-resident who derived income from Singapore. One fine morning.

An IRS Verification of Non-filing Letter is proof authenticated by the IRS that the applicant or the person whose name is in the IRS letter did not file an income tax return in Form 1040 1040A or 1040EZ for the year written therein. Non Tax filers can request an IRS Verification of Non-filing of their 2017 tax return status free of charge from the IRS in one of three ways. A nonresident alien individual who is not engaged in a trade or business in the United States and has US.

A tax return is a form or forms filed with a tax authority that reports income expenses and other pertinent tax information. The Tax Code considers failure to file ITR and failure to pay income tax as crimes of the same nature and gravity because these two crimes are found in the same Section 255 of the Tax Code and they carry exactly the same penalties. I thought I had filed my 2018 tax year taxes in April 2019.

Rakesh Mourya is a regular Income Tax payer who files his Income Tax Return every year on time. ITR V It is the acknowledgement of filing the return of income. Comparing the advantages and disadvantages of being tax filer and non-filer source in FBR said that immediately after filing income tax returns the name of the filer would be enlisted among the active taxpayers whereas in case of failure in filing tax returns by due date the taxpayers would have to wait for one whole year to become active.

It doesnt indicate whether you are required to file a return for that year. A representative or agent responsible for filing the return of an individual described in 1 or 2. Your total income is more than 22000.

Modes of filing the return of income Return Forms can be filed with the Income-tax Department in any of the following ways -. A VNF does not provide proof that you were not required to file only that you did not file. A student or parent who has never filed a federal tax return will need to complete an.

Well the people in India has the biggest fear of the being raid by the IT people if they choose to file the income Tax returns regularly nd this is why they do. The Tax Code considers failure to file ITR and failure to pay income tax as crimes of the same nature and gravity because these two crimes are found in the same Section 255 of the Tax Code and they carry exactly the same penalties. Individuals required to file tax.

An IRS Verification of Non-filing Letter provides proof that the IRS has no record of a filed Form 1040 1040A or 1040EZ for the year you requested. An IRS Verification of Nonfiling Letter VNF will provide proof from the IRS that there is no record of a filed tax form 1040 1040A or 1040EZ for the year you have requested. Furnish return under section 1394A or section 1394B or section 1394C or section 1394D ie trusts political parties institutions colleges.

Under section 206AB of the Act on any sum or income or the amount paid or payable or credited by a person herein referred to as deductee to a specified person who has not filed the returns of income for both of the 2 Assessment Years relevant to the 2 Previous Years which are immediately before the Previous year in which tax is required to be deducted or collected as. Each ITR penalty mentioned in the above table is subject to several conditions. We have no record of a filed Form 1040 1040A or 1040EZ using the above.

Most Important Benefits Of Filing Nil Income Tax Returns

What Is Professional Tax Legal Services Tax Tax Accountant

Tax Filing Chatbots Filing Taxes Income Tax Tax Brackets

How To Handle Notices From The Income Tax Department Income Tax Income Tax Preparation Filing Taxes

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

How To Register On The Income Tax Website And File Returns Income Tax Income Tax Return Filing Taxes

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Delinquent Taxes Infographic How To Pay Off Or File Late Taxes Tax Debt Tax Help Filing Taxes

Section 206cca Higher Rate Of Tcs For Non Filers Of Income Tax Return Income Tax Return Income Tax Income

July 4th Wishes Filing Taxes Happy Independence Day Income Tax

Income Tax Filing India Itr Filing Taxation Policy In India Filing Taxes Income Tax Income Tax Return

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only D Online Taxes Income Tax Filing Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

Www Rehadol Biz Business Tax Income Tax Return Tax Refund

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)